Buying LEIs: Where and how to find the right LEI issuer

Imagine you want to start a business in Florida, and you need to register it; where would you go?

Technically speaking, you head to the local authority unit in charge of business incorporations in Florida. There, you’ll find the right bodies.

When looking to buy an LEI Number – which is almost like registering your business globally – it’s normal for people to think they have to go to a local organization unit in their jurisdiction. Like, say, you’re in London and need to obtain the Legal Entity Identifier for your brand in London. Then you must go to an LEI Local Operating Unit (LOU) in London.

Well, this is not so.

LEI is a dynamic and flexible business validation system that works just the same way anywhere. Being a globally-certified code, there are no conflicts of details in LEI creation. Each LEI number generated is unique in its own right. Meaning that whether you get your LEI from a London LOU or you get it from an agent based in Singapore, it makes no difference.

This makes sense if you think about it.

LEI Numbers are generated when codes get assigned to entities – codes generated based on the ISO 17442 standard developed by the International Organization for Standardization (ISO). For an LOU (anywhere in the world) to create an LEI Number for an entity, it has to access the global LEI code database to generate the alphanumeric digits. Once generated, this code goes into the global LEI index and is recognized globally as being the LEI code for that entity. Thus, making it impossible for anyone (anywhere in the world) to generate a similar code for their entity.

What are LOUs?

Local operating units (or LOU, for short) are GLEIF-accredited organizations responsible for issuing LEI numbers. These bodies handle all things LEI-related for a certain jurisdiction.

They are accredited and charged by the Global Legal Entity Identifier Foundation (GLEIF) (GLEIF) to handle LEI registration, renewal, and other services.

If anyone wishes to get an LEI Number for their business, the fastest step is to locate the accredited LOU in their jurisdiction. However, since LEIs are the same regardless of the issuing LOU, entity owners can easily use any LOU they find, provided they’re certain it’s an accredited one.

How would you know that a Local Operating Unit for LEI is the legit one?

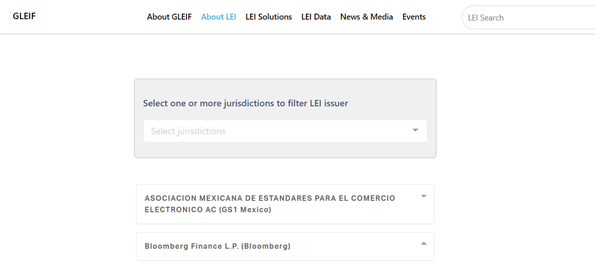

Well, the simple way to know is to visit the GLEIF site and filter the search to the jurisdiction you’re in. there, you’ll find a table identifying all GLEIF-accredited LEI issuers that offer LEI services per jurisdiction.

The table looks like this:

To find out the LEI issuers in any given country (jurisdiction), simply filter the search to that area.

LEI Issuer accreditation: What is it?

Before an organization can become a local operating unit, it must be accredited by GLEIF.

This process of accreditation is known as the phase of LEI issuer accreditation. And it is done to ascertain the suitability of organizations seeking to operate within the Global LEI System as LEI issuers.

As expected, anybody can express their interest in being an LOU. But in order to keep up with the global standards of LEI Numbers, not every candidate can be admitted into the system. This is why accreditation is mandatory.

An important part of being a member of the LEI issuing community is adherence to strict data quality and customer service. Without this, an organization will not be recognized as an LEI issuer, and their certificates will be revoked.

How do LEI issuers issue LEI codes?

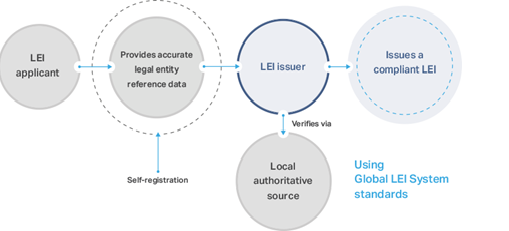

Obtaining an LEI registration requires that the legal entity provide the ‘reference data.’ This data is the framework upon which your LEI number is based. It is what validates the authenticity and transparency of your brand.

Technically speaking, a legal entity is expected to provide the following details when applying for LEI registration with an issuer:

- Official name and address of the business

- Direct owners or stakeholders of the legal entity

Basically, you have to provide information that answers the question of ‘who is who’ and ‘who owns whom.’

Of course, an LEI issuer is expected to do a background check on a legal entity before proceeding to issue an LEI code. This is a part of the strict data quality standards they have to adhere to.

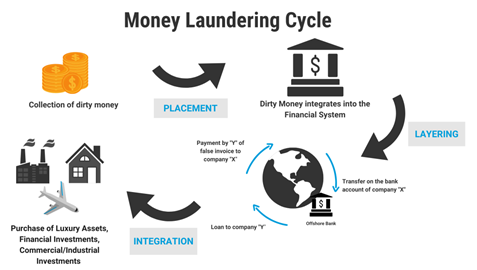

With the estimated amount of money laundered globally being roughly $800 billion – $2 trillion yearly, LEI issuers cannot afford to take the words of a legal entity for it.

Extensive background check is a must.

So, when you apply for LEI Number, expect your issuer to verify your details at your local business registry. Don’t worry; they have the right to do so.

How do LEI issuers report registered LEI Numbers to the appropriate bodies?

Once an LEI Number is generated for a legal entity, the details of that creation get published on the Global LEI Index.

In addition to this, accredited LEI issuers are expected to send ‘Data Quality Reports’ to bodies like GLEIF to certify that they’re complying with the industry standards.

Why are there so many agencies and websites offering to run LEI registrations for clients?

Because they’re registered partners of accredited LEI issuers.

In order to make the process of LEI registration seamless and encourage people to hop on the train, GLEIF introduced the concept of LEI Registration Agents.

The idea is to make websites for LEI applications available everywhere you go. This way, legal entities have no reason not to register.

At their core, LEI registration agents help clients access LEI issuing organizations in their jurisdictions. A simple Google search of the term ‘LEI’ will return hundreds of these agents to you. Such is the extent of their popularity in the industry.

Why hire an LEI registration agent?

Going by all we’ve said so far; you want to believe you can DIY your LEI registration. And quite rightly so. After all, all you need is to:

- Find an LEI issuer in your jurisdiction

- Supply your details to the issuer

- And then await their response.

However, the reality is far from being that simple.

There are advantages to hiring LEI registration agents. Which is why people (legal entities) do it.

Common reasons people use registration agents for their LEI applications

- LEI management

Getting an LEI is only a part of the job; you have to maintain the number, keep it updated, renew your status yearly, and tick several boxes.

To be honest, most legal entities have trouble keeping up with all these requirements.

With the daily business burden already weighing heavily on your shoulder, asking you to cram the date of an LEI renewal or update your status to reflect a new board member can be too stressful.

Luckily, this is where LEI registration agents come into the picture. When you use an agent to handle your LEI registration from the get-go, they’ll be charged with managing the number without you even having to ask.

- Handling of multiple LEIs

If you’re in a business where your clients also use LEIs, it may be a wise choice to help them manage their LEI numbers.

But in order to do that, you’ll need a seamless system that automates the process to avoid forgetfulness or confusion.

Examples of businesses with clients that use LEIs may include:

- Investment managers

- Banks

- Financial traders

- Brokers

- Financial advisors

- Etc.

- Customized LEI systems

Imagine being notified by a telephone notification that your LEI is about to lapse; how beautiful would that be?

Obviously, that will make it impossible to miss LEI renewals.

Well, customization features like these are what you get from LEI registration agents.

- Alleviating common challenges associated with financial transactions

It goes without saying that LEI Numbers are now crucial to global financial transactions involving valuable assets like stocks, CFDs, cryptocurrencies, bonds, cash investments, etc.

In order to avoid delays while trading these assets, an LEI registration agent is highly essential. Delays can come from lapsed LEI status – for you or your clients. It can also come in the form of LEI regulatory complaint issues.

With the kind of high-end services you get from LEI registration agents, delays and regulatory issues will never be a cause of concern for you. These issuers can provide you with essential tools like portfolio management, back-end management, employee access, LEI deployment, and so much more.

- Seamless LEI registration

As with every form filling process, completing an LEI application form can cause you some headache. Being your first time, you may have trouble understanding some terms in the Level 1 and Level 2 data sections.

Then there is also the possibility of supplying not-so-accurate information in sections where you don’t clearly understand what to input.

To prevent these possibilities, you should work with a registration agent instead. LEI registration agents are always happy to help first-time LEI seekers navigate the process. They’ll assist you in filling your form in a matter of minutes so that you can pass the necessary checks and get your LEI ASAP.

How to choose an LEI issuer to work with

As we said, there are many LEI registration channels on the internet today. Looking at the sea of options, it may be difficult to know which one to choose.

To help out, we’ve compiled a couple of tips.

- Confirm the authenticity and legality of the agent

Coming into an LEI website, it is ok the first thing you want to ask is how much is their service? But you really should hold off on that for a second.

Remember we said LEI registration agents are partners with accredited LEI issuers. Now, when you come into an LEI website, the first thing you should ask is who their accredited partner is.

Most companies will paste this information somewhere on the website. But if they don’t, you should ask. Once you know their accredited partner(s), you can verify their identity on the GLEIF website as described earlier.

- Find out about their extra services

As you can imagine, not all LEI registration agents are created equal. Some offer unique services that bolster the overall package.

For instance, we spoke about portfolio management and back-end management earlier. Not all LEI issuers offer this. There are other extra services like bulk LEI registrations, Auto LEI renewals, advanced LEI profile updating, etc.

Ask the issuer what is comprised in their package before you proceed.

- Don’t forget to ask about the length of registration and issuance

Technically, registration is supposed to be completed in a matter of minutes. And your LEI Number is supposed to be verified and issued on the same day.

Sometimes, depending on the issuer, things might take longer.

So, before proceeding, you should ask important questions like:

- How long does your registration take?

- How long before my details are verified, and the LEI is issued.

Again, note that registration should be painless and swift. At most, it should take one day. If you’re being told otherwise, feel free to find another issuer. Remember, LEI seekers are not bound or limited by an issuer from one jurisdiction. You can be in Canada and work with an LEI agent from London.

- Ask about LEI transfer

Thanks to the fact that LEIs aren’t bound by location, one can register with an issuer in a certain location and then move their registration details to another issuer in another country.

That is, say you register with an issuer in New York and then discover another issuer in Ontario that charges less; you can easily ask your previous issuer for LEI transfer.

In this case, they’ll simply move your information to the database of the new issuer.

You should note that the process of LEI transfer can be painstaking at times, especially since the issuer will be losing a customer. Therefore, before you register with an LEI agent, ask about the swiftness of their LEI transfer system.

- Industry-standard compliance

The Legal entity identifier space is an ever-dynamic one. There are new developments and requirements hitting the market from time to time.

The best issuers know to keep up with these standards.

One latest development that’s making the rounds lately is iXBRL reporting. It is a form of digital signature service required by some agencies and financial regulatory bodies. If you think or know you’re in a field where such is required, then you clearly need to ask your issuer if they have a provision for issuing LEIs within digital certificates.

- Uninterrupted customer experience

Another important point to ask an LEI agent before proceeding to register with them is their KYC and customer onboarding structure.

That is, do they have a setup that synchronizes customers’ information from the LEI registration stage to the financial service registration stage?

This sort of synchronization is essential because you don’t want your customers to have to go through a rigorous LEI application procedure only to finish and then still have to fill other forms to perform the actual action they came for.

As you can imagine, such rigorous procedures are recipes for bad customer experience.

- Custom-tailored services

Every legal entity is different. What your business needs might be different from mine. And an LEI issuer is meant to understand this.

When you want to buy your legal entity identifier number, you should ask the provider whether they offer services tailored to your business needs. Of course, you’ll need to explain what your business does in detail. Then they can make suggestions to enhance your processes with LEI.

- Consider the price

Don’t fall for providers charging cut-throat figures.

Of course, the big names like Bloomberg charge as high as £65-90 +VAT. But there are providers charging for lesser.

You simply have to do your research.

The GLEIF has made the industry a fairly competitive one so that LEI seekers can have pricing options when looking to buy.

- Do your research

Brands like London Stock Exchange and Bloomberg are household financial names. They’ve been around even before LEIs came into being.

Buying from these sorts of names requires no research as you trust them already. But on the downside, they make you pay for this trust. That’s why their rates are on the high side.

To enjoy competitive pricing, one needs to come down the ladder a little bit – to where the lesser-known companies are.

It might be worrying patronizing a brand you’ve never heard of. But you have nothing to worry about. When in doubt, pick up your phone and call the issuer. If you’re still not convinced, look them up online. By the time you repeat that for up to 10 issuers, you should find one that sits well with you.